5 Best Payoneer Alternatives in 2025 for International Payments in India

Why Consider Alternatives to Payoneer?

Payoneer is a widely used global payment platform that helps freelancers and businesses manage cross-border payments with ease. It provides virtual accounts in multiple currencies and integrates with major marketplaces like Amazon, Fiverr, and Upwork. However, for many users – especially in India – Payoneer’s fee structure and policies can be a drawback. Key examples include:

- High transaction fees: Up to ~3.2% on credit card payments and other client payments

- Forex markup on withdrawals: ~3% fee for converting and withdrawing funds to INR

- Inactivity fee: $29.95 annual fee if you receive less than $2,000 in 12 months

These costs add up and eat into your earnings. As a result, many Indian freelancers, SaaS founders, exporters, and other businesses are exploring alternative platforms that offer lower fees, faster settlements, and better local support. In the sections below, we’ll highlight some of the leading Payoneer alternatives – Skydo, Wise, PayPal, PingPong, Stripe, Tipalti, and others – and how they compare in terms of features, costs, and compliance support.

Skydo: India-Based Payoneer Alternative

Skydo is an India-focused international payments platform designed for exporters and freelancers. It provides local virtual bank accounts in multiple countries (including the US, UK, Canada, and Australia), so your overseas clients can pay into a “local” account without using SWIFT. Skydo’s offerings are tailored to Indian users seeking cost efficiency and compliance ease:

- Transparent pricing: Simple flat fees – $19 per transfer up to $2,000, $29 for $2,000–$10,000, and 0.3% for amounts above $10,000 – with no hidden forex markup or spreads. There are also no monthly or inactivity fees for maintaining your account (unlike Payoneer’s $29.95 charge for low-volume users).

- Quick settlements: Funds in USD, EUR, GBP, etc., are converted at real-time rates with zero margin and typically credited to your Indian bank within 1 business day (occasionally 2 days for larger amounts). This is faster than Payoneer’s usual 2–3 day timeline.

- Instant compliance docs: Skydo automatically generates a Foreign Inward Remittance Advice (FIRA) for every payment, at no extra cost. This simplifies tax compliance (e.g. GST refunds) for Indian exporters. Skydo’s integration with Amazon Global Selling means Amazon marketplace payouts come with an auto-generated eBRC, saving sellers a lot of manual paperwork, a feature Payoneer doesn’t provide automaticall

- Built-in invoicing: The platform offers a GST-compliant invoicing tool so you can bill your international clients directly and track payments easily.

- India-based support: A local customer support team is available to assist with queries, understanding Indian banking norms and compliance needs.

Pros:

- Market-rate FX with no markup: You get the full mid-market exchange rate on conversions (0% forex margin), maximising the INR amount you receive.

- Cost savings on fees: The flat fee structure can save you a substantial amount on large payments – for example, a $10,000 payment would incur just $29 in fees on Skydo, versus at least 3%, up to $300 via Payoneer. Many users report saving over ₹3,000 on every $1,000 received by switching to Skydo.

- Automatic FIRA/eBRC: Every incoming payment automatically comes with a digital FIRA (evidence of foreign payment) at no charge, which is a huge compliance advantage for Indian exporters. Amazon global sellers also get automated eBRC, something that is not available on Payoneer.

- Global reach with local focus: You can receive from 150+ countries in multiple currencies, but still enjoy fast INR deposits and India-specific features (like GST invoices and local support). This “best of both worlds” approach combines Payoneer’s global scope with an India-centric experience.

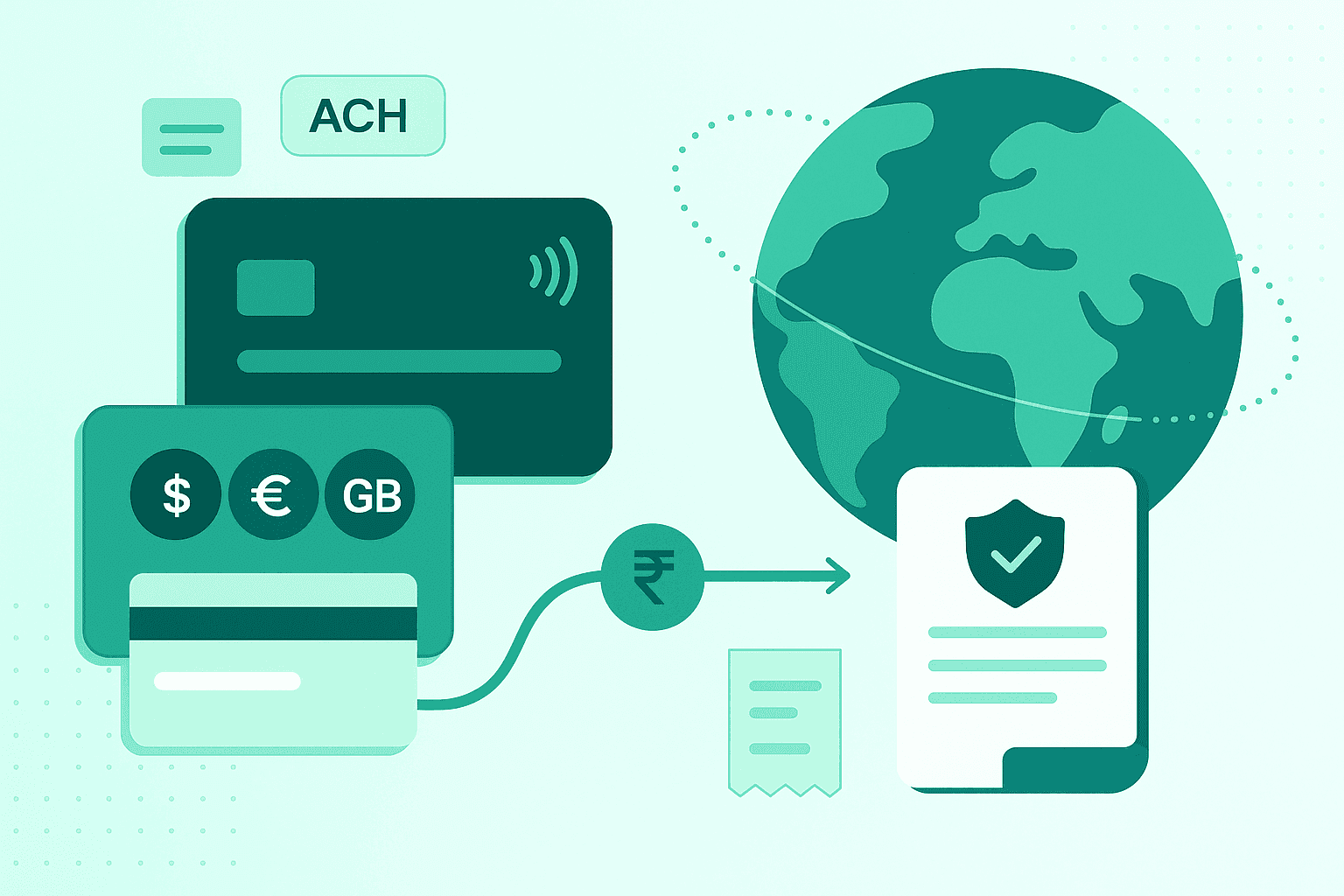

- Card & ACH for US clients: You can also create and send a Skydo payment link to your US clients, and they can pay by card or netbanking, and you get INR at live FX with free FIRA

Cons:

- Inbound only: Currently, Skydo supports receiving international payments into INR only. It does not yet support outbound international transfers or multi-currency holding. (Payoneer allows outbound payments.)

- Flat fee impact on very small transfers: For transfers below ~$200, Skydo’s flat $19 fee might be higher as a percentage compared to platforms that charge, say, 1-2%. So micro-payment users might find percentage-based fees more economical.

Bottom line: Skydo’s India-centric approach – zero forex markup, flat, affordable fees, instant FIRA, and fast local settlements – often makes it a better alternative to Payoneer for Indian freelancers and businesses. If you receive international payments and want to maximise what lands in your bank account, Skydo is built for that. (With Skydo, you save about 50% on fees for a typical transaction, and your money arrives faster with compliance taken care of.)

Wise Business: Global Alternative with Mid-Market Rates

Wise (formerly TransferWise) is another popular alternative known for low-cost international transfers. Wise Business accounts offer:

- Mid-market exchange rates: Wise always uses the real mid-market rate for currency conversion, with no hidden markup. They instead charge a transparent conversion fee (~1.6–1.8% for major currency routes). This can be cheaper than Payoneer’s ~3% currency spread for large payments.

- Multi-currency account: You can hold and manage money in 40+ currencies. Wise provides local bank details in USD, EUR, GBP, AUD and more, allowing you to receive payments like a local.

- Batch payments & integrations: For businesses, Wise lets you batch pay up to 1,000 recipients, useful for payroll or multiple invoices. It also integrates with tools like Xero and QuickBooks, and offers a mobile app for easy tracking.

- Fast transfers: Wise is known for speed – about 80% of transfers complete within 24 hours, significantly faster than traditional bank wires.

Pros:

- Transparent, affordable fees: You see exactly what fee will be charged and the exchange rate. No monthly account fees, and no nasty surprises in conversion rates.

- User-friendly: The platform is very popular among freelancers for its intuitive interface and reliability. Sign-up is straightforward and there’s no maintenance fee.

Cons:

- Extra compliance fees: Wise provides an e-FIRC (Foreign Inward Remittance Certificate) for compliance, but they charge an additional fee of about $2.50 per FIRC for USD payments (and equivalent for other currencies). These small charges can add up if you do many transactions (Skydo provides FIRA free with each transfer).

- Inbound limits: You can only receive up to USD 10,000 per individual invoice on WiseLarger payments might need to be split or use another platform. Also, Wise does not support outgoing business payments from India due to local regulations.

- Freelancers and sole proprietors only: Currently, Wise business only supports freelancers and sole proprietors in India. Other entities, like private limited and LLPs, are not supported as of now.

Wise’s clarity on fees and mid-market rates has made it one of the top Payoneer alternatives globally. It’s especially suitable if you prioritise transparent pricing and hold multiple currencies. However, if you need India-specific features (like instant INR compliance docs or local support) or if your single invoices often exceed $10k, you may need to consider other options like Skydo.

PayPal: Globally Accepted but Costly Alternative

PayPal is a household name for international payments and might be considered an alternative to Payoneer, especially given its wide acceptance. Many overseas clients are comfortable with PayPal. Key points for Indian users:

- Global acceptance: PayPal is used in over 200 countries and by millions of merchants. Clients (particularly in the US/EU) often trust PayPal’s buyer/seller protection for payments.

- Multi-currency support: You can accept payments in 25+ currencies. PayPal will convert foreign currency and let you withdraw in INR.

- Built-in invoicing: PayPal offers free invoice creation with payment links, which is handy for freelancers billing clients.

Pros:

- Trusted worldwide: The brand recognition is huge. Many clients prefer paying via PayPal as it’s familiar and they may already have accounts.

- Instant transfers within network: PayPal-to-PayPal transfers are instant. If your client pays from their PayPal balance or linked card, you receive it immediately in your PayPal account. Hiwever

- Automatic FIRA (India): For Indian accounts, PayPal provides a monthly Foreign Inward Remittance Advice statement at no extra cost, consolidating all transactions. This helps with compliance (though it’s not per transaction, it’s periodic).

- Buyer Seller Protection: PayPal offers buyer and seller protection, protecting both buyers and sellers from non-delivery of products, fraud and unfair claims, respectively

Cons:

- High fees for Indians: PayPal can be a rather expensive option for receiving payments in India. It charges about 4.4% per transaction (for commercial payments) plus a fixed fee, and then an additional ~3-4% in currency conversion markup. In total, you might lose ~7-8% of your earnings in fees when using PayPal – significantly more than Payoneer or others.

- Feature limitations in India: Many advanced features (recurring billing, mass payouts, PayPal debit card, etc.) are not available for Indian users. You can withdraw funds to your bank, but you cannot hold a foreign currency balance beyond 24 hours due to regulations. Also, PayPal India accounts cannot receive payments from other Indian PayPal accounts (international only).

In summary, PayPal’s ease of use and global ubiquity are its strong suits – if a client insists on paying via PayPal, it’s an option. However, for most freelancers and small businesses in India, PayPal turns out to be a pricier alternative to Payoneer. Many prefer specialised services like Skydo or Wise that charge less, except in cases where PayPal’s buyer protection or familiarity is a must-have.

PingPong: E-Commerce Friendly Payoneer Alternative

PingPong is a fintech platform popular with Indian e-commerce sellers (especially those selling on global marketplaces like Amazon or eBay). It positions itself as a direct competitor to Payoneer for marketplace payouts. Notable features include:

- Marketplace integrations: PingPong seamlessly connects with major e-commerce platforms. For example, Amazon can disburse your sales earnings directly to your PingPong account, and PingPong will handle the conversion to INR. It essentially auto-collects payouts from sites like Amazon, Walmart, eBay, Shopee, etc., similar to Payoneer’s store integrations.

- Free FIRA & GST support: The platform automatically issues an FIRA for each incoming payment and provides reports to help with GST filings for exports.

- Competitive Fees: PingPong offers multi-currency accounts and charges a 1% fee, which is quite competitive compared to a lot of platforms.

Pros:

- Tailored for online sellers: If you’re an Amazon or eBay seller receiving international customer payments, PingPong is designed for you. It centralises different marketplace earnings and simplifies operations – a true Payoneer alternative in the e-commerce domain.

- Compliance handled: Free FIRA for each transaction and integrated tax documentation are a big relief for exporters. You don’t have to chase banks or pay extra for these compliance papers.

- Simple fee structure: A flat ~1% fee on incoming amounts, all-inclusive. This is easier to understand than Payoneer’s layered fees.

Cons:

- Percentage fee on large volumes: While 1% is decent, on very large transfers or high-volume businesses, that fee can add up. (E.g. $10k receipts would incur ~$1oo in fees on PingPong.) In such cases, a flat fee model like Skydo’s might save more.

- Lack of clarity on forex rates: PingPong’s exchange rate isn’t clearly disclosed, so it’s important to check carefully. The rate you see on Google reflects the true mid-market exchange rate — the same one banks use without any markup. If PingPong’s rate differs, it likely means there’s a hidden exchange rate fee built in.

Overall, for merchants selling products abroad, PingPong simplifies getting paid from marketplaces and provides a viable alternative to Payoneer. However, to know whether it is the best Payoneer alternative, it is important to know how much you are paying, including forex markups, if any.

Stripe: Developer-Friendly Alternative (Invite-Only in India)

Stripe is a global payments powerhouse known for its flexible APIs and tools for online businesses. While primarily a payment processor for merchants (to accept customer payments), Stripe also offers capabilities for sending payouts and holding balances, which can make it an alternative to Payoneer in some scenarios. Key things to note:

- Extensive API and customisation: Stripe is highly developer-centric. Businesses can integrate Stripe into their websites or apps for accepting payments, set up subscription billing, manage marketplaces, etc. It offers everything from hosted payment pages to advanced fraud detection. This flexibility is unmatched, which is why many startups and SaaS companies love Stripe.

- Advanced features: Stripe provides recurring billing, invoice management, detailed financial reporting, and more. It’s constantly innovating new services (tax calculators, identity verification, etc.), acting as a one-stop payment infrastructure.

Pros:

- Unmatched global reach and tech: If you need to build a custom payment flow or integrate payments deeply into your product, Stripe is best-in-class. It can scale as you grow (many Fortune 500 firms use Stripe).

- Full control and branding: You can fully white-label the experience. From checkout design to email receipts, Stripe lets you craft how your clients or users experience payments. This is something Payoneer (which is more off-the-shelf) doesn’t offer.

Cons:

- Limited availability in India: Stripe’s services in India are invite-only for certain cross-border features. As of 2025, an Indian business cannot simply sign up and start using Stripe for international payouts unless approved (they had limited beta trials). This means that for most Indian freelancers or small firms, Stripe might not even be accessible as a Payoneer alternative yet.

- High fees for international transactions: Even if you do get access, Stripe isn’t cheap. Standard pricing is ~2.9% + 30¢ per transaction for card charges, and an extra 1% fee on international cards or currency conversions. Effectively ~3.9% (plus fixed fees) on foreign payments, which is higher than Payoneer’s typical cut. For payouts from Stripe to Indian bank accounts, you’d also face those conversion fees.

- Not focused on recipient-side features: Stripe is great for collecting payments from customers, but not focused on providing the recipient with tools like multi-currency withdrawal options or localised support. It doesn’t, for example, generate FIRA documents or offer specialised forex solutions for your earnings. It’s assumed you’ll use the banking partners it supports.

In short, Stripe can be a powerful alternative if your use-case involves running an online business or platform with global customers – it’s more a competitor to payment gateways than a direct Payoneer replacement for freelancers. Given that it’s currently restricted in India and has higher costs, most users would find more India-friendly options like Skydo, Infinity, or Karbon to be better for simply receiving international payments.

Stripe is a good Payoneer alternative if you need deep customisation and can get access in India. Otherwise, more India-friendly options (Skydo, Infinity, etc.) are likely better.

Tipalti: Enterprise Payoneer Alternative for Mass Payouts

For larger organisations that need to pay out hundreds or thousands of recipients globally (such as marketplaces, affiliate networks, or SaaS platforms), Tipalti is a comprehensive solution often mentioned alongside Payoneer. Tipalti isn’t just a payment receiver – it’s a mass payments and accounts payable automation platform. Here’s what it offers:

- Wide global reach: Tipalti supports transactions in 196 countries and 120+ currencies. No matter where your payees are, Tipalti likely can get funds there. This global coverage is broader than Payoneer’s core offering (Payoneer covers ~200 countries, but Tipalti is built into enterprise systems worldwide).

- Multiple payment methods: The platform offers 50+ payment methods for paying out money – including ACH, wire transfers, global ACH, PayPal, prepaid debit cards, etc. Essentially, a company using Tipalti can let each payee choose how they want to receive funds, and Tipalti handles it behind the scenes.

- Automated compliance and tax handling: Tipalti’s strength is automation. It can collect tax forms (W-8, W-9 for U.S. compliance), handle GST or VAT needs, and perform automatic fraud monitoring on payouts. This reduces the manual work for finance teams, ensuring things like TDS or VAT are accounted for and payments are legally compliant across borders.

- Streamlined mass payouts: If a company needs to pay, say, 500 freelancers worldwide every month, Tipalti can automate that entire workflow – from onboarding the payees (supplier management) to scheduling payments, executing them in bulk, and reconciling the amounts. This end-to-end process is what sets Tipalti apart from a basic tool like Payoneer.

Pros:

- All-in-one platform: Tipalti is essentially an enterprise-grade upgrade over Payoneer. It not only moves money internationally, but also handles many adjacent finance tasks (invoice processing, payment approval workflows, etc.). Businesses with large-scale payouts find that it saves a lot of time and reduces errors.

- Customizable and integrated: Tipalti can integrate with ERPs and accounting software. It’s highly customizable for a company’s needs (with APIs, branded payment portals, etc.). This is a pro if you’re an enterprise needing a tailored solution.

Cons:

- Not freelancer-friendly (directly): Tipalti is not a tool for individual freelancers or small businesses to sign up and use on their own. It’s typically the payer (a company) that signs up for Tipalti to pay others. So, if you are the one receiving money, you can only use Tipalti if your client/company uses it to pay you. In contrast, Payoneer or the other alternatives in this list can be initiated by the receiver.

- Cost and complexity: Tipalti is an enterprise software solution; it likely involves a contract, setup fees or subscription fees for the company using it. It’s worth it for the scale (and often saves money on FX with its competitive rates), but it’s overkill for individuals. Smaller businesses may find it too complex, whereas with something like Skydo or Wise, they can start using in minutes.

- Focus on payouts, not collections: Tipalti shines for accounts payable. If your need is primarily collecting payments from clients (accounts receivable), Tipalti isn’t the right tool – it’s not something you’d ask a client to pay you through. Payoneer, Skydo, etc., are better for collections; Tipalti is more for disbursing funds.

In essence, Tipalti is a top choice for companies that need a scalable, automated payout system and are perhaps outgrowing the simplicity of Payoneer. It’s frequently used by companies in the gig economy, affiliate networks, or global marketplaces to pay contributors around the world. If you’re a solo freelancer or small business, you generally wouldn’t use Tipalti yourself – instead, you’d pick one of the other alternatives on this list that cater to receiving client payments.

Other India-Based Payoneer Alternatives

In recent years, several Indian fintech platforms have emerged to help local businesses receive international payments faster and cheaper. These are built with Indian regulations, banking systems, and user needs in mind. Two notable ones are Karbon and Infinity:

Karbon

Karbon is a fintech platform designed for Indian exporters and service providers who want a fast, seamless way to collect payments from abroad. It’s often pitched as a Payoneer alternative with an emphasis on eliminating bank hassles. Key features:

- Virtual accounts in major currencies: Karbon provides you with local account details in USD, EUR, GBP, etc., to share with clients (similar to Payoneer)

- Quick INR settlement: It promises to credit your Indian bank account within 24–48 hours of payment, reducing the wait compared to traditional wire transfers.

- Zero forex markup: Karbon offers live mid-market exchange rates with 0% markup on conversions. Essentially, you get the actual market rate, and they charge a separate fee (so no hidden spread in the rate).

Why consider it: Karbon’s simple, streamlined interface and hands-on compliance support make it a strong Payoneer alternative for Indian agencies, SaaS companies, and exporters. It’s particularly appealing if you have faced delays or complex paperwork with banks.

In terms of cost, Karbon advertises 0% FX markup and up to ~1% in fees (depending on volume) – which is competitive, though higher than Skydo’s flat 0.3% on large transfers. Essentially, Karbon focuses on speed and simplicity, catering to businesses that want a plug-and-play solution for cross-border collections.

Infinity

Infinity positions itself as a lightweight, cost-effective alternative to Payoneer aimed at Indian freelancers and small businesses. It focuses on maximising what you receive by cutting fees to the bone. Notable points:

- Flat low fees: Infinity charges a 0.5% fee on incoming international payments. There are no additional forex markups; 0.5% is all-inclusive, which is significantly lower than Payoneer’s ~3–5% effective cost.

- No inactivity fee: Unlike Payoneer’s $29.95 annual charge for low-volume accounts, Infinity has no inactivity or account maintenance fees. Even if you receive infrequent payments, you won’t be penalized.

- User-friendly dashboard: Infinity offers an easy-to-use interface with invoice tracking and basic reporting, making it straightforward to request payments and monitor incoming funds.

- Local support: Like Skydo and Karbon, Infinity provides customer support geared toward Indian users, which can be helpful when resolving issues or understanding compliance.

Why consider it: If minimising fees is your #1 priority and you’re dealing with moderate transaction sizes, Infinity is very attractive. For example, on a $1,000 payment, Infinity would take $5 (0.5%), whereas Payoneer might take around $30+ in various fees.

The no-frills approach (no debit cards, no multi-currency holding – just receiving and converting to INR) keeps it simple and low-cost. It’s a great option for freelancers or small export businesses who want to avoid high forex fees and don’t need the broader marketplace integrations that Payoneer offers.

(Note: Other regional fintech alternatives include the likes of Xoom (by PayPal) for remittances, or Statrys (a Hong Kong-based FX platform), which targets Asian SMEs. However, for India-specific use, platforms like Skydo, Karbon, and Infinity currently lead the pack in balancing cost and convenience.)

Payoneer vs. Skydo: Quick Comparison

To put things in perspective, let’s compare receiving a $10,000 payment through Payoneer vs. Skydo:

- Using Skydo: You would pay a flat $29 fee and no forex markup. Your funds would be converted at the live market rate and deposited into your Indian bank, usually within 1 business day. Compliance documents (FIRA) for the full $10k are instantly available for your records. You’d receive nearly the full ₹ value of $10,000 (minus that $29).

- Using Payoneer: The fees depend on how the payment comes in and out. Even if it's a local account transfer which doesn't carry any fees, when you withdraw to your INR account, Payoneer’s 3% currency conversion fee applies. Credit card and ACH transfers have further charges. In total, you could lose up to 3-6% of the amount in various fees by the time it’s in your bank. That could be around $300-$600 on $10,000.

That’s a huge difference in net amount received – and illustrates why many users are switching. If you’re collecting multiple payments every month, saving 3-5% on each transfer means a lot more money in your pocket over the year.

While Payoneer remains a reliable, well-established platform with global reach, newer services like Skydo are offering India-focused improvements: more savings, faster INR payouts, and built-in compliance.

The bottom line: if receiving international payments is a big part of your business and you want to retain more of your earnings, it’s worth considering a Payoneer alternative that aligns with your needs.

Which is better than Payoneer?

Payoneer is a stalwart when it comes to enabling international payments. However, in terms of cost and customer support, Skydo can be a better alternative to receiving international payments in India

How trustworthy is Payoneer?

Is Payoneer better than Stripe?

What is the best Payoneer alternative for freelancers?

. What factors should I consider when choosing a Payoneer alternative?