Top Cross-Border Payment Solutions for Indian Businesses & Freelancers

India’s cross-border payments market is booming. Recent government data show that exports hit USD 602.64 billion during Apr–Dec 2024 (up 6% year-on-year)as per pib.gov.in, reflecting growing international trade and freelance work.

As more Indian SMBs and freelancers serve global clients, the challenge is receiving those payments quickly, compliantly, and affordably. Hidden fees, delayed processing, and complex paperwork are common complaints.

In this guide, we compare the leading platforms used by Indian businesses to receive international payments smoothly, so you can choose the best one for your needs. We include both homegrown fintechs and widely used global services for context.

Skydo

Key Features/Pros

- Purpose-built for Indian businesses: Skydo is a modern cross-border payments platform designed specifically for Indian exporters, SaaS companies, and freelancers. Skydo focuses on solving India-specific frictions, like compliance, forex markup, and documentation.

- Zero forex markup, transparent pricing: Skydo charges a flat fee: $19 for payments under $2,000, $29 for $2,001–$10,000, and 0.3% beyond that. There’s no currency conversion markup, meaning businesses receive the exact mid-market rate (the same you see on Google).

- FIRA included, instantly: Skydo auto-generates digital FIRA after every transaction at no additional cost, making GST filing and RBI compliance hassle-free.

- Payment Tracking and Invoicing: Skydo also lets businesses know where their payments are at any point in time via their payment tracking. Its invoicing feature also helps exporters create and share their invoices directly via Skydo

- Unlimited transaction support & local help: There are no limits on how much you can receive, and Skydo supports all business types, freelancers, sole proprietors, and registered companies. Indian customer support is available on WhatsApp, email, and phone.

Cons

- Inbound Payments Only: Currently, Skydo supports only inbound payments, meaning it’s not a full payment gateway for paying vendors.

- Less Ideal for Small ticket sizes and card payments: For amounts below $1,000, certain % based providers may prove to be more affordable, and as of today, Skydo doesn't support card payments.

PayPal

Key Features/Pros

- Global acceptance & convenience: PayPal is one of the most recognised payment solutions worldwide. Many international clients (especially individuals and small buyers) are comfortable using PayPal, making it easy for them to send money using a credit/debit card or their PayPal balance.

- Automatic FIRA compliance: PayPal offers monthly digital FIRA to Indian businesses at no extra charge. Businesses get a single FIRA for all transactions each month, usually by the 15th of the following month, making compliance easier.

- Buyer-Seller Protection: PayPal has inbuilt buyer-seller protection, protecting both buyers and sellers from financial loss in case of fraud.

Cons

- India Feature Gaps: PayPal’s service in India is more limited compared to other regions. Indian merchants can only use it for receiving foreign currency payments, with restrictions on other advanced features.

- Fees and currency conversion costs: For receiving payments from outside India, PayPal charges 4.4% of the amount plus a fixed fee per transaction. On top of that, PayPal applies a 4% currency conversion fee when converting foreign currency to INR. I

Payoneer

Key Features/Pros

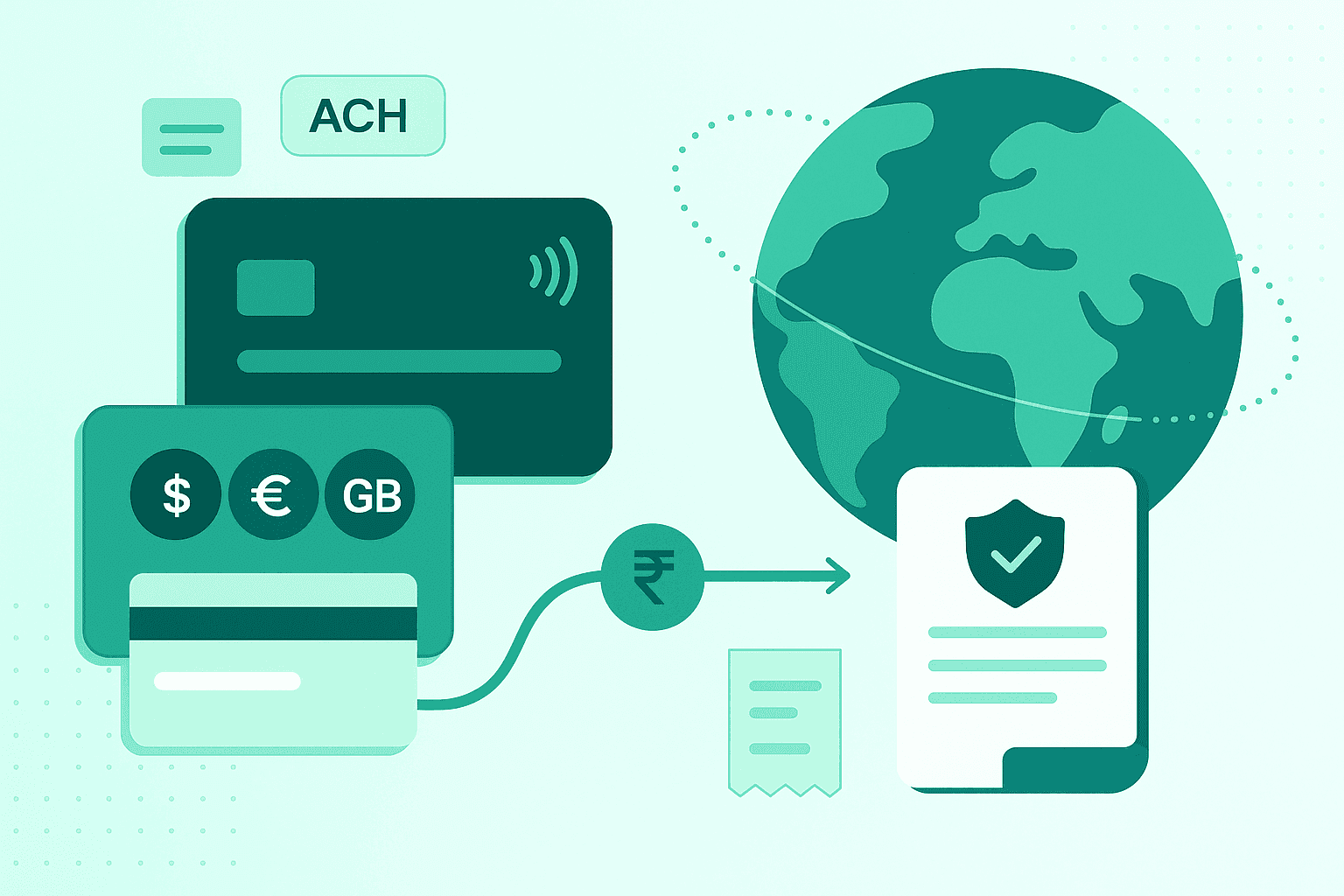

- Multi-Currency Receiving Accounts: Receive payments in USD, EUR, GBP, and more with local account details (e.g., ACH in the U.S., SEPA in Europe), making it easier for international clients to pay as if you had a local bank account.

- Marketplace Integrations: Seamlessly connects with platforms like Upwork, Fiverr, Airbnb, Amazon, Walmart, etc., ideal for freelancers and e-commerce sellers relying on these networks.

- Free FIRA/FIRC Documents: Indian users receive digital FIRA/FIRC at no additional cost with every incoming transaction, simplifying compliance.

Cons:

- Transaction Fees Vary by Method Credit card payments: 3.2% + $0.49 ACH debits: 1%

- Forex Markup on Withdrawals: A 3% currency conversion fee applies when withdrawing to an Indian bank account, which can add up for large transfers.

- Annual Maintenance Fee: An annual charge of $29.95 applies if your account receives less than $2,000 in payments over 12 months.

Wise Business

Key Features/Pros:

- Mid-Market FX Rates: Wise offers currency conversion at the real mid-market rate, which helps businesses save on hidden fees compared to platforms that apply markups.

- User-Friendly: Wise’s interface is intuitive, making it easy for freelancers and small businesses to manage their payments without complexity.

- Global Coverage: Wise provides local bank details in various currencies and supports payments in over 80 countries.

Cons:

- FIRA is Paid: Wise does give a digital FIRA for Indian users, but charges $2.50 each. Minor cost, but not free like Skydo/Payoneer.

- $10k Invoice Limit: They have a cap of $10k per transfer request for business accounts, which might be restrictive for larger deals

- Limit on business types supported: Wise Business currently only supports freelancers and sole proprietors in India.

Stripe

Key Features / Pros:

- Developer-Friendly Gateway: Ideal for SaaS and tech businesses needing global card payments. Offers powerful APIs for custom integration, including recurring billing, invoicing, and one-click checkouts.

- Global Currency Support: Supports 135+ currencies and various local payment methods, making it suitable for businesses with an international customer base.

- Advanced Business Tools: Includes built-in fraud detection, revenue analytics, subscription management, and invoicing features, suitable for businesses seeking an all-in-one payment platform.

Cons:

- Fees for Indian Merchants: Stripe charges ~4.3% transaction fee + 2% forex conversion fee for international payments, which can be costly over time.

- Invite-Only Access in India: Currently, Stripe is not open to all Indian businesses. You need to request access and wait for approval, which may delay setup for new exporters or freelancers.

- No FIRA/FIRC Provided: Stripe does not issue FIRA/FIRC for Indian users, adding a compliance burden for businesses that require these documents.

Other Notable Options

Apart from global platforms like PayPal and Wise, several India-specific players are also building solutions tailored for exporters and freelancers. Here's a quick look:

- EximPe: RBI-authorised export finance platform that assists with FIRC generation and supports receiving payments in major currencies; it offers bundled export financing, but fee structures vary by corridor.

- Razorpay International: A trusted Indian fintech with multi-currency support and automated digital FIRC issuance; best suited for SMEs and startups.

- Karbon Business: Provides exporters and startups with cross-border payment support and invoice discounting; delivers FIRC compliance but charges ~1% on transactions and leans toward larger exporters.

- Infinity: Offers zero FX markup, instant FIRA/FIRC with every withdrawal, real-time forex rates, ideal for freelancers and SMBs

Receive affordable and compliant cross-border payments with Skydo

If you're an Indian freelancer or SMB receiving international payments, your choice of platform directly impacts your profits and compliance. While players like Razorpay, EximPe, and Karbon offer solid features with varying fees, Skydo stands out for one reason: unmatched cost transparency. With zero forex markup, instant FIRC, and an RBI-approved infrastructure, Skydo is built specifically for Indian exporters.

For large-value payments in USD, Skydo consistently delivers higher take-home payouts without the complexity, delays, or hidden charges. If saving money and staying compliant matter, Skydo is the smarter, simpler choice.

How many cross-border payment aggregators are there in India?

There are currently around 10-15 active cross-border payment aggregators in India, with few major players dominating the market for freelancers and small businesses.

What are the examples of cross-border payments?

Is Skydo RBI approved?