Infinity Payment: Features, Fees And Alternative

Infinity Payment is a platform for receiving cross-border payments in India. Based in Bangalore, it allows Indian businesses, like exporters and freelancers, to create multi-currency accounts to manage international payments.

If you are in the market evaluating tools like Infinity Payment, this blog post is for you. In this comprehensive analysis, we explain the core features of Infinity and its fee structure to help you decide if it's the right fit for your business. We also cover a more seamless and affordable alternative, so we suggest reading this blog till the end.

Infinity Payment: A Quick Rundown

Here are the four most essential points you must know about Infinity Payment before you decide to sign up for a demo:

Global Account: When you create an account with Infinity Payment, this single account allows you to receive payments in different currencies. Your clients can pay you in 30+ currencies, and you don’t have to worry about currency conversion

Free Digital FIRA: With every withdrawal, you get a FIRA. This helps you stay compliant and reduce administrative workload

Live Forex Rate, No Markup: An international payment is converted to domestic currency based on the prevailing exchange rate. Moreover, there is no markup or hidden fees, which ensures you get the best value for the payment

Personalized Treasury Management: Infinity Payment offers curated portfolios of government securities, mutual funds, and fixed deposits to help you earn from the idle cash in your account. This is an interesting offer if you have been exploring investment opportunities to grow interest income from international payments

Infinity Payment Fees: How Much Do You Pay?

Let’s understand the most important section of the blog: How much do you pay as fees for receiving international payments? To make the calculations easier, we assumed that you have received a payment of USD 10,000 from a foreign client.

Transaction fee: Infinity Payment charges a transaction fee of 0.5% of the amount. For receiving a payment of $10,000, the fee will be $50 (0.5% X $10,000). They also offer custom pricing for payments above USD 50,000.

Live forex rate: The amount you receive is converted to domestic currency based on the current exchange rate. Let’s assume the current rate is 85 INR to 1 USD for the next step.

| Amount received from the client | $10,000 |

| Transaction fees | $50 |

| Balance amount | $9950 |

| Amount value in INR after deducting fees(9950 X 85) | Rs. 845,750 |

In summary, you pay $50 (INR 4,350) as fees for receiving $10,000 (INR 850,000) via Infinity payments

Skdyo: A Seamless Infinity Payment Alternative For Receiving International Payments

If you’re open to exploring options for international payment solutions beyond Infinity Payment, then Skydo is worth considering.

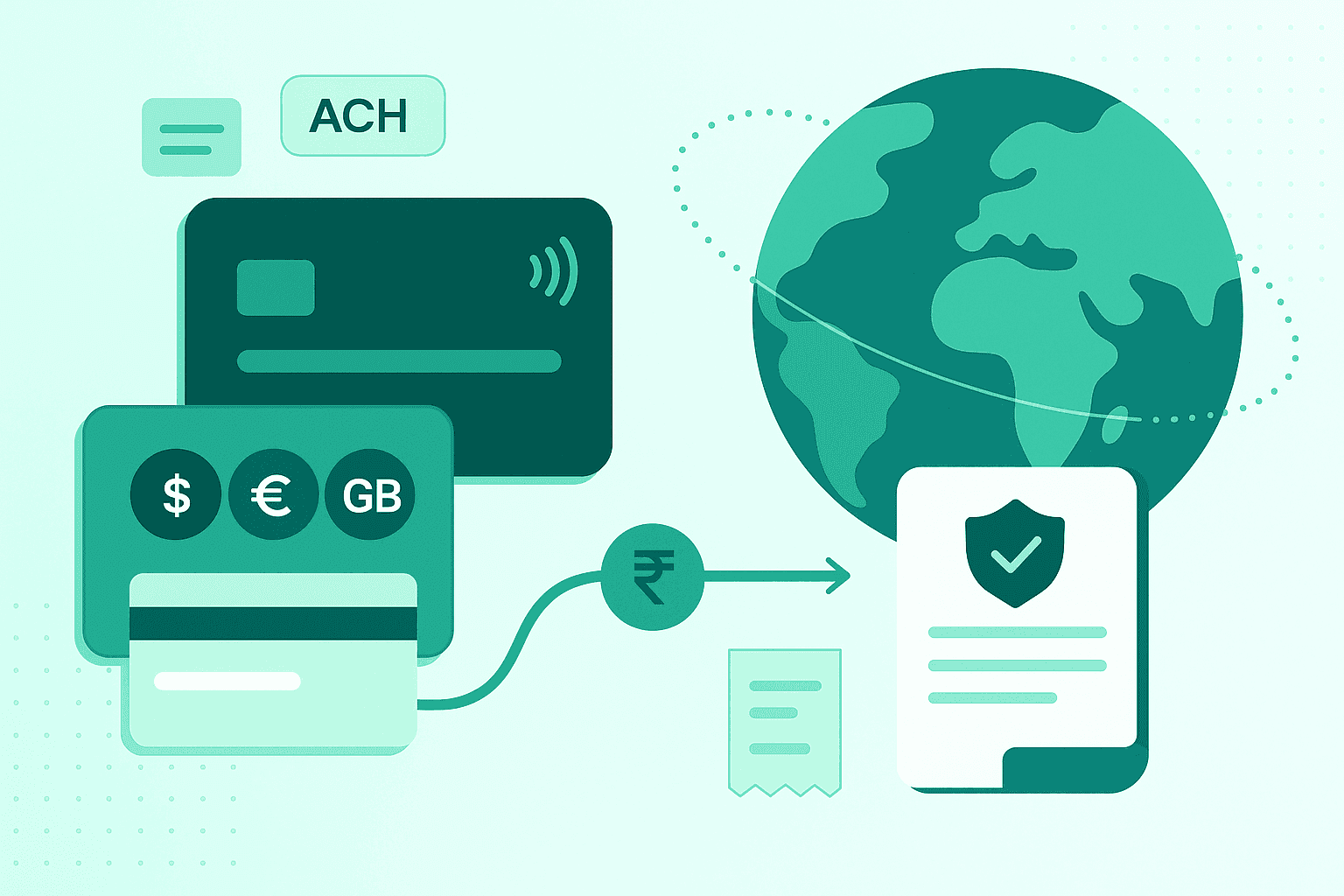

Skydo is affordable and offers transparent pricing, especially on significant transactions, catering to different client needs. In contrast to Infinity Payment’s percentage-based fees, Skydo follows a flat fee model as follows:

- $19 for payments up to $2,000

- $29 for payments between $2,001-$10,000

- Just 0.3% for payments above $10,000

For example, a $10,000 payment would incur a flat fee of $29 with Skydo.

This structure can make Skydo more cost-effective for mid to high-value transactions. However, for smaller amounts, particularly under $1,000, percentage-based platforms may sometimes offer lower fees depending on their pricing model.

In addition to providing global accounts in countries like UK, USA, Australia, and Canada, the following features make Skydo a great choice for Indian businesses:

- The onboarding is quick. You can get started in 5 minutes

- Skydo has an India-based support team that assists you proactively during the onboarding process.

- Free FIRA every time you receive a payment

- GST-compliant invoicing

- Payment tracking with a reminder facility

- Built-in business analytics tool.

Skydo also integrates with Amazon Global Selling and major freelance marketplaces that further help you streamline international payments in a single platform.

Does Skydo sound like the ideal international payment solution for your business?

What is Infinity Payment?

Infinity Payment is a payment platform designed to receive cross-border payments in India. It simplifies international transactions by providing multi-currency accounts, transparent fees, and fast payment processing, making it easier for businesses to manage cross-border operations efficiently.

Is Infinity Payment an India-based company?

What is the fee structure of Infinity Payment